The Senior Notes Editor of Syracuse Law Review is a position that covets many roles. An “SNE” must guide the 2L members through their Note writing process, contribute to the executive board of the Law Review, supervise 3L Associate Notes Editors in their duties, and stay on top of reading and research in order to best assist those 2L members who are doing the same.

During the academic year of 1985-1986, Kim Boylan served as the Senior Notes Editor of Syracuse Law Review (then known as the Notes & Comments Editor). She, of course, sharpened her writing skills, practiced lessons in leadership, and was exposed to a variety of topics and personalities. Thankfully, lessons such as these do not wear off easily, for today, Kim is a partner at White & Case in Washington, D.C., where she serves as Head of the 100-member Global Tax Practice.

Kim began her educational journey in Washington, D.C., when she attended Georgetown University. Graduating as an accounting major, and then receiving her CPA, Kim briefly considered law school before deciding to work for Ernst & Young (which was then known as Ernst & Whinney).

For most of the year, she worked with large clients on the auditing side of EY. She appreciated the audit work, but there was something attractive about the area of tax law. So, she focused on this area during the summer when audit work was slow. Through this exposure to tax law, she gained invaluable experience and it “confirmed for [her] that [she] wanted to go to law school.”

Starting in her second year at Syracuse Law in 1984, Kim dived into tax law head first. She took tax classes and trial practice, participated in Moot Court, joined Law Review, and even wrote her Law Review Note about the tax law governing certain stock transfers.

“One particular professor I remember was Marty Fried,” she said. “He really loved tax, and his love of the subject was infectious. He was an incredible mentor and very encouraging, especially to people like me who wanted to make tax their future.”

Immediately upon graduation, Kim began an exciting career in tax. She first clerked at the United States Court of Federal Claims. “[B]eing a good writer is a very important skill to have,” she said. “Law Review was very helpful in that regard. I gained writing skills that I have used throughout my career from the time spent reviewing and editing the notes of others and writing my own Note. These skills are essential to success as a lawyer….If you have strong writing skills, you will be presented with greater opportunities in your legal practice.”

After clerking, Kim went to work for Dow Lohnes and Albertson PLLC, followed by Mayer Brown. At Mayer Brown, she became a partner and focused on tax litigation.

Kim was fortunate to be involved with two seminal cases at Mayer Brown. The first case involved Riggs Banks (now PNC Bank), a “small player” selected by the IRS as a test case.

“Riggs was selected by the IRS as a test case on tax issues stemming from Brazil’s threat to default on all of its outstanding debt,” she said. “This debt crisis involved banks world-wide that had lent funds to Brazil and, had a restructuring not occurred, the world-financial system was in peril of collapsing. The specific issue involved in the litigation was whether U.S. lenders were entitled to foreign tax credits that arose from the interest Brazil eventually paid on the restructured debt.”

The Riggs litigation carried on for thirteen years, traveling up-and-down to the D.C. Circuit Court on four different occasions. Kim views this case as her version of ‘Bleak House.’

The second case involved U.P.S. and the taxation of the funds collected when the declared value of a package exceeds $100. “One would not have thought that the 25 cents per $100 of excess value coverage paid by U.P.S.’s customers could ever result in a major tax issue, but those quarters add up and, at the time, this case was one of the largest tax cases ever heard by the United States Tax Court.”

Following her time at Mayer Brown, Kim went on to be a partner at Latham & Watkins. There, she also focused on tax disputes work. Today, she’s carried all of those experiences into White & Case, where she enjoys working with large corporate clients who have complicated IRS tax disputes. She said the one common denominator in all of her work is that there’s always a difficult issue that needs to be resolved. Sometimes it’s a winner, sometimes it’s not, but it always requires a lot of factual development.

With a storied career such as Kim’s, the question remains: what can today’s students do to work their way into a career like hers? Her response: be willing to work for it.

“Being a professional is not the same as being an employee,” she said. “Sometimes the professional has to send an email at 11p.m. before bed. You do have to check your email on the weekends. The difference between the good lawyers and the bad ones is the understanding that this is a profession, not a job. The people that make it are the ones that know that.”

This story was written by Legal Pulse Editor Samantha Pallini and is the fourth installment of Syracuse Law Review’s new monthly feature, “Alum of the Month.” Stay tuned for next month’s feature on another noteworthy Syracuse Law Review alumnus.

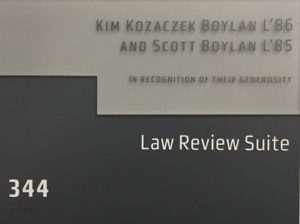

Note from the Legal Pulse Editor Each day, the editorial members of Syracuse Law Review walk through the doors of Suite 344 to work on their edits and prepare for future issues. We want to thank Kim Boylan, whose name graces a plaque above our office door, for championing Law Review students and encouraging us in our work!